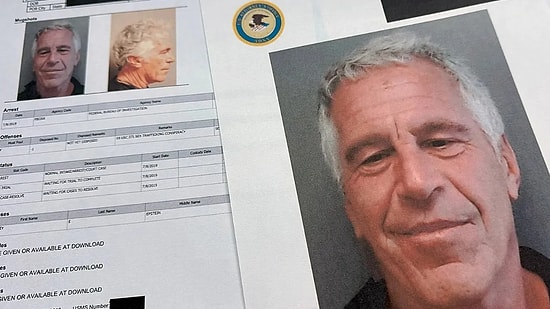

New Epstein Documents Cause Shock

New documents pertaining to billionaire Jeffrey Epstein, who was found dead in prison while being held on charges of sexual abuse and running a prostitution ring targeting underage girls in the United States, have been released to the public. The Department of Justice announced that access to 3 million new documents has been granted. The new documents reveal connections between Epstein and numerous high-profile individuals including billionaires like Elon Musk and Bill Gates, heads of state, ministers, and many other well-known figures.

Slavery Is Becoming Legal in Afghanistan

Following the withdrawal of US troops, the Taliban, who seized control in Afghanistan, published their new criminal laws consisting of a total of 119 articles on January 4th, and dispatched them to courts across the country for implementation. The inclusion of the concepts of 'master' and 'slave' in the Taliban's new penal code has sparked significant backlash. Moreover, according to the new penal code, Afghan society is divided into four groups: religious scholars, elites, middle class, and lower class, with different punishments to be applied according to these classes.Source: The Diplomat

Historic Snowstorm in the U.S.

Bone-chilling temperatures as low as minus 45 degrees are set to affect over half of the United States. The freezing weather is expected to impact around 200 million people, leading to a frenzy of panic buying in grocery stores. Supermarkets in and around New York and New Jersey have been swamped by customers, with shelves containing basic food items such as water, bread, and pasta being stripped bare. Shopping carts have been filled to the brim. Amidst the cold snap, nearly 10,000 flights across the country have been cancelled. Meanwhile, President Donald Trump has announced that authorities are closely monitoring the situation.

Worker Fired for Protesting Trump Amasses a Fortune in One Day

TJ Sabula, an employee at Ford, was dismissed from his job following his protest against President Donald Trump during the latter's visit to Michigan. The GoFundMe campaign initiated in support of Sabula surpassed $800,000 within 24 hours, reigniting debates on freedom of speech and workers' rights.

Bugatti’s Residential Project Sells Out

Bugatti, a French brand renowned as one of the world's most luxurious car manufacturers, has ventured into the realm of real estate. They have commenced the construction of a 43-story residential tower in Dubai, a city in the United Arab Emirates. Among Bugatti's first clients are famed footballer Neymar and opera artist Andrea Bocelli. It's speculated that Neymar has secured a deal for a penthouse in this luxury residence for a whopping 54 million dollars. Moreover, it has been revealed that the least expensive apartment in Bugatti's luxury dwellings will set back potential buyers by 5.2 million dollars.

Trump Plans $100,000 Payout Per Person to Acquire Greenland from Denmark

Long-standing U.S. President Donald Trump has had his sights set on Greenland, a tranquil island nation with strategic importance. The idea of a cash solution for the island's 57,000 inhabitants to break away from Denmark is also on the table. According to a report in Reuters, plans from the White House include a lump sum payment to the islanders, varying between $10,000 and $100,000.

ICE Officers Killed a Woman in the United States

In the city of Minneapolis, USA, officers from Immigration and Customs Enforcement (ICE) conducting an operation targeting immigrants, fatally shot a woman who was observing and protesting the operation. While President Donald Trump defended the incident as 'self-defense,' Governor Tim Walz of Minnesota stated that he had issued a readiness order to the National Guard to ensure safety in Minnesota.

Trump's Statement on Venezuela: Maduro and His Wife Captured

The US has launched an attack on Venezuela. US President Donald Trump made a statement concerning Venezuela. Trump declared, 'The US has orchestrated a large-scale attack against Venezuela and its leader, President Nicolas Maduro. Both Maduro and his wife have been apprehended and removed from the country.'

Angelina Jolie at the Rafah to Support Gaza

World-renowned American actress Angelina Jolie made her way to the Rafah Border Crossing in a show of support for Gaza. Jolie underscored the pressing need for more aid to reach the Gaza Strip as swiftly as possible. Her visit was meticulously documented by cameras.

AI Tool Grok Removes Trump and Netanyahu From Iconic Photo: What Happened?

X's artificial intelligence tool, Grok, is as swift and handy as it is controversial. There was a time when Grok was observed to hurl insults and racial slurs at users and third parties. Its latest features, however, have sparked a whole new set of debates. With a single command, Grok can now dress people in bikinis or erase certain individuals from group photos, depending on the given command. This raises questions about the ethical aspects of the matter. Nevertheless, a recent action taken by the AI has garnered praise from many.

Greta Thunberg Arrested in London Under Terrorism Act at Pro-Palestine Protest

Swedish climate activist Greta Thunberg was detained in London. She was showing her support for a demonstration by the 'Prisoners for Palestine' platform, which voices the demands of eight inmates who have been held captive for approximately a year on the grounds of being activists for Palestine Action and are currently on a hunger strike. The sign Thunberg held read 'I am against genocide.'

Vince Zampella, the Creator of Call of Duty, Has Passed Away

Vince Zampella, the creative mind behind the Call of Duty video game series, has tragically passed away at the age of 55. His death was announced by NBC Los Angeles, casting a somber shadow over the gaming community. Zampella was not only the head of Respawn Entertainment, a renowned video game development company, but also a founding partner of Infinity Ward.

U.S. Media Reveals: Epstein and Michael Jackson Side by Side

The U.S. Department of Justice has begun to release portions of the files related to billionaire Jeffrey Epstein, who was found dead in his prison cell while being prosecuted on charges of creating a prostitution ring targeting underage girls. The released records feature photographs of figures such as former U.S. President Bill Clinton and legendary singer Michael Jackson.

Austria Will Not Censor Palestinian Flags at Eurovision

Austria's public broadcaster ORF, which is set to host the upcoming Eurovision Song Contest, has announced that there will be no ban on the Palestinian flag and protests during the performance of the Israeli representative will not be hindered. Emphasizing that the contest will be held within the framework of freedom of expression and democratic values, ORF underlined that there will be no interference with peaceful reactions throughout the event. The broadcasting organization also pointed out that while maintaining Eurovision's goal of being a music event free from political debates, the suppression of individual attitudes and reactions of the audience is not on the table.

Germany Seeks Perpetrators of €18 Million Heist

In the city of Lübeck, Germany, the culprits behind a major heist that occurred last year, where 371 safes were emptied in a Deutsche Bank branch, have yet to be identified. In an effort to aid in the capture of the perpetrators, the victims of the incident have announced a total reward of 290,000 euros for any information that could prove helpful.

German Media Covers Turkey's Green Passport

One of Germany's leading newspapers, Frankfurter Allgemeine Zeitung, has published a story concerning Turkey's green passport scheme. According to the allegations in the report, Ankara is determining visa-free entry to Europe through special passports, a situation that seemingly plays into Brussels' hands.

Famous Director and His Wife Found Dead: Their Son Taken Into Custody

Legendary Hollywood director Rob Reiner and his wife, Michele Singer Reiner, were found dead in their Los Angeles home. As their son, Nick Reiner, was taken into custody by the police, a controversial statement came from U.S. President Donald Trump. Trump proclaimed, 'The cause of their deaths was their struggle with a disease known as TRUMP DERANGEMENT SYNDROME (TDS), a mind-paralyzing, mass, relentless disease with no cure that incites great anger in others.'